Retrospective and Outlook of M&A in China’s New Energy Industry in 2022

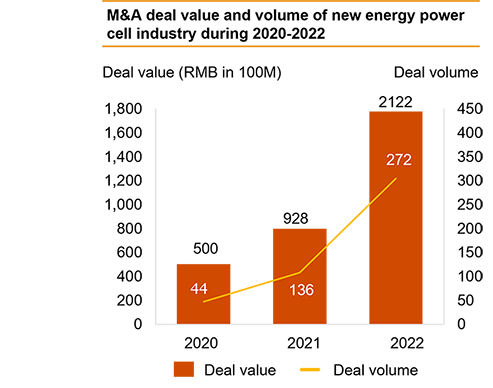

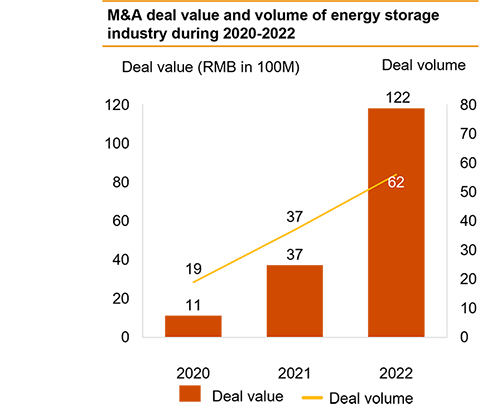

In 2022, the disclosed M&A deal value of China new energy industry M&A amounted to RMB391.7 billion, with a total of 716 deals, hitting a record high level since the start of our reporting. The compound annual growth rate stood at 45% in the past three years, and it is expected to remain high in the future.

Overview of investment and M&A trends

Total deal value

RMB 391.7 billion, up 24%

Total deal volume

716, a 10% increase

Average disclosed deal value

RMB 720million, up 22%

M&A mega deals

3 mega deals exceeding RMB 10 billion, with a total value of nearly RMB 68 billion

Major investment sectors

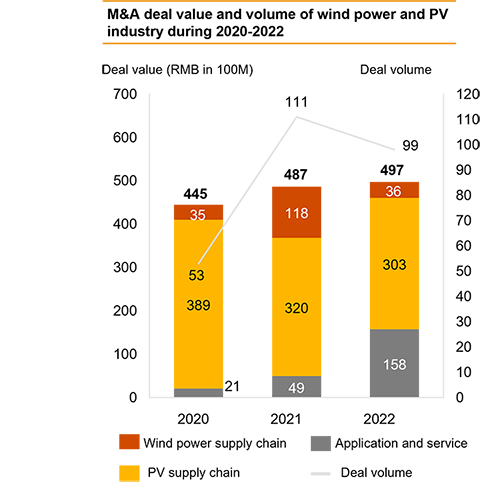

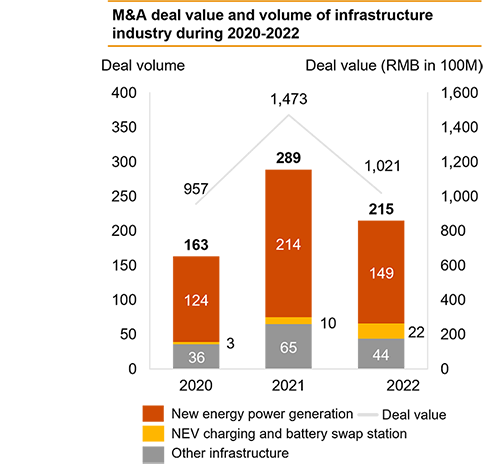

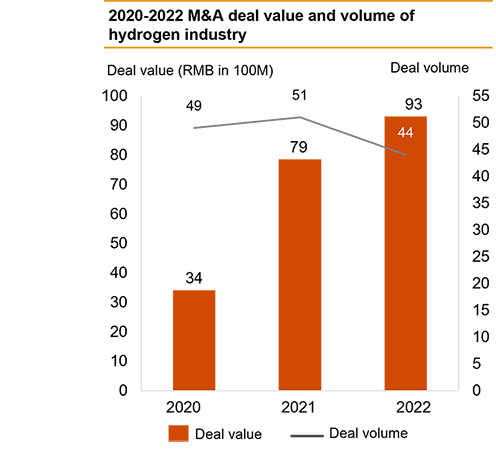

Lithium batteries, infrastructure, wind power & PV supply chain were the most popular sectors

Active investors

Activities of private enterprises reported a historical high

Main investment direction

Domestic deals, accounts for 95% of both volume and value

Cross-border deals

Outbound deals continue to recover, with deal volume hitting a three-year high

Highlights of M&A deals by sector

The sectors covers the accelerated development of new energy vehicles that led to the steady increase in investment value of the whole industry value chain including lithium batteries, wind power & PV, energy storage and hydrogen energy, infrastructure sector.