Download the report

26th Annual Global CEO Survey China Report

CEOs brace for a dual-imperative world amid China’s reopening

For over two decades, the PwC Annual Global CEO Survey has offered a rare glimpse into the minds of CEOs from all around the world. This year, to celebrate its 26th anniversary, the survey was extended to 105 countries and territories, with responses from 4,410 CEOs.

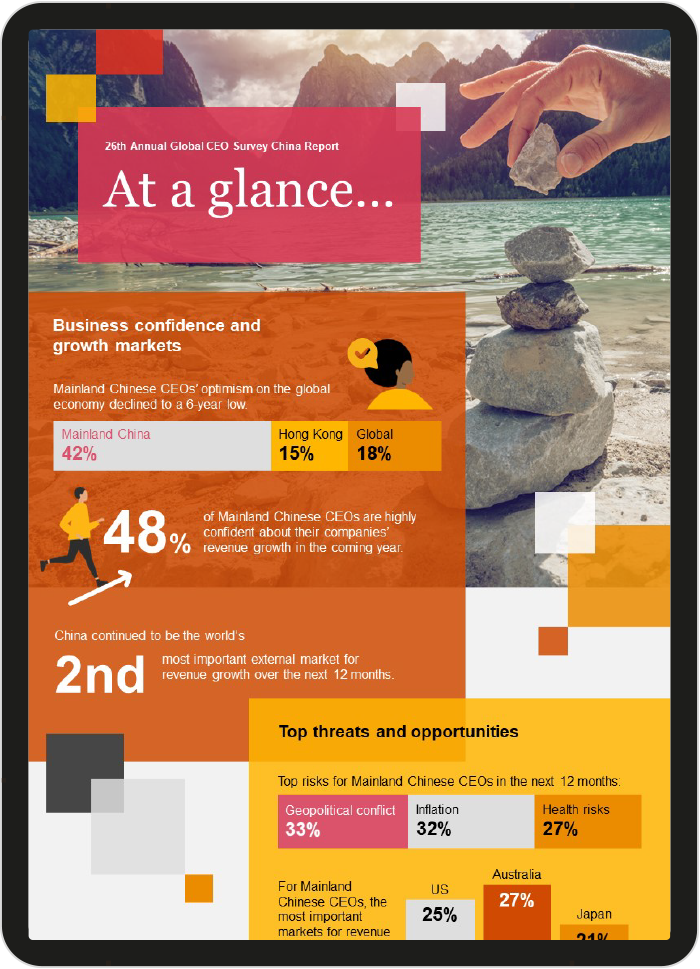

The China report is especially noteworthy, as the results came out in tandem with the latest economic reopening of the country as it seeks to resume growth amid the COVID-19 pandemic, and shed light on what new challenges and opportunities mean for business leaders, as they explore what it takes to operate in our dual-imperative world. They will likely find themselves in a new race to ensure business viability and profitability today, while rebalancing priorities to drive sustainable growth for tomorrow.

Implications for business leaders

- Long-term success hinges on Chinese businesses’ ability to respond to changing customer preferences and technology disruptors, mitigating impacts of climate change, keeping costs down in light of inflation, all while navigating a more complex international geopolitical landscape.

- C-suite executives must broaden the scope and scale of the insights they have access to. This means looking at sector-specific issues, geopolitical shifts, inflation and climate change.

- Executive leadership needs to mobilise and be empowered to take action and make decisions that will help the business reach its long-term strategic goals and remain resilient.

- CEOs should take a disciplined approach that focuses on capabilities. This means looking at business drivers through a capability lens to decide which investments should be prioritised and which costs should not be cut or limited.

- Chinese CEOs should use the current business environment as an opportunity to reinvent their organisational culture. They should build up their talent model by focusing on capability building, recruitment, and retention initiatives.

- To effectively enable a successful transformation and stay relevant in the long-term, CEOs should look to form alliances that involve financial, technical, talent and technology capabilities.

‘Chinese businesses will find themselves in a more volatile environment in 2023 as they face growing inflation caused by demand recovery, geopolitical risks, health risks and climate change. Although China’s reopening has injected optimism into the global economy, CEOs in Mainland China and Hong Kong will still need to master the balancing act of running today's race and navigating long-term economic viability with investments that strengthen their capabilities.’

Contact us

Managing Partner - Markets, PwC China

Tel: +[86] (10) 6533 2838 / +[852] 2289 8288