View this page in: 简体中文版

Redesign, redefine and redeploy the tax function to be a strategic business asset

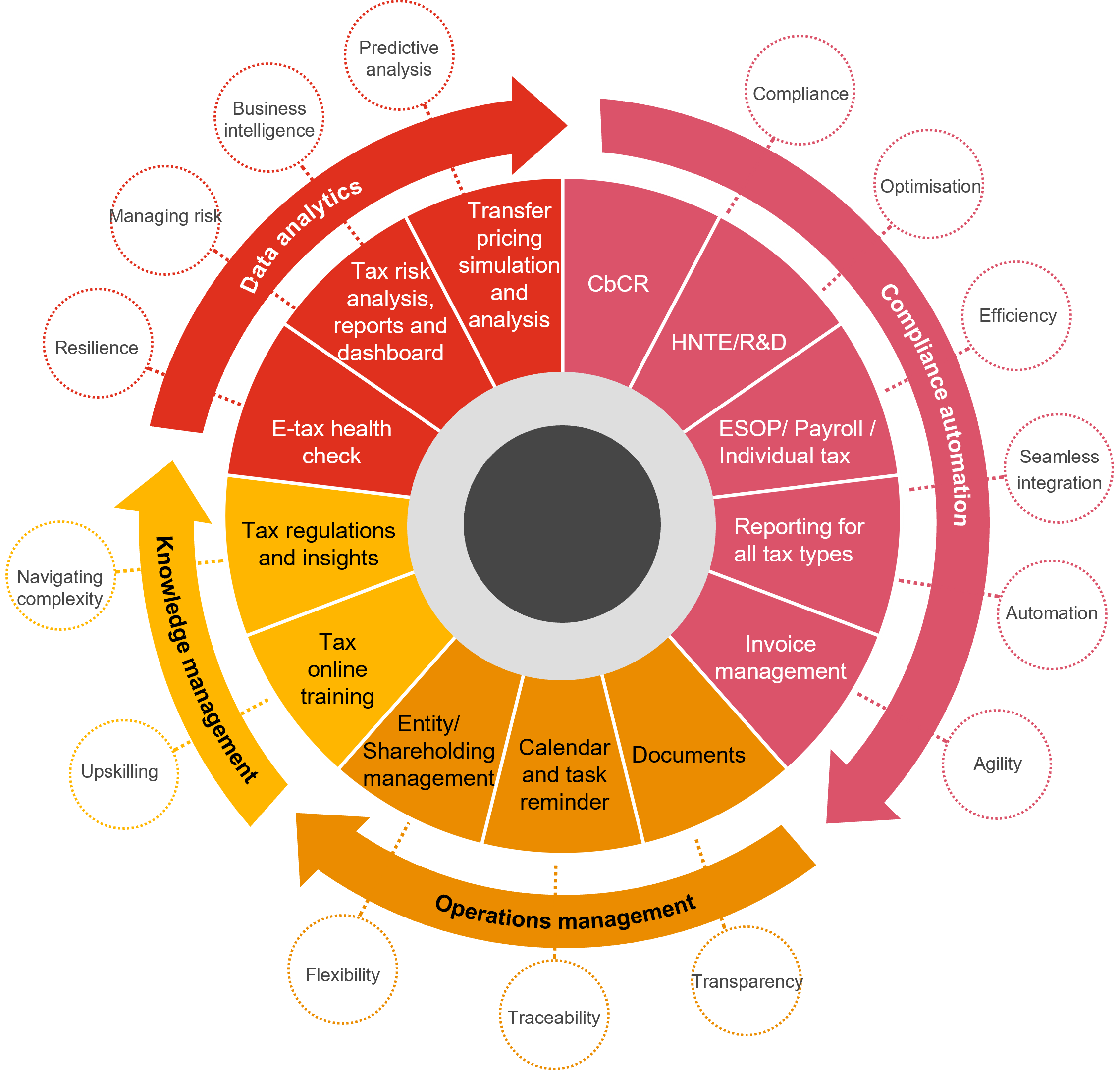

Increasingly, tax functions understand the value of leveraging technology to drive greater efficiency, improve tax processes and manage risk. In a fast changing world, we’re helping our clients to build a tax function for the future. Our complete approach to tax management brings together tax function design, technology and compliance delivery. By aligning our client’s tax and tax technology strategies with their commercial goals, the tax function will become a strategic asset, adding value across the organisation.

About Tax Technology

As the world transforms to a technology-driven and data-enabled environment, forward-thinking companies realise the value of leveraging technology and data to drive greater efficiency, improve tax processes and manage risk. By adapting to technology, tax functions can now have the ability to contribute more strategically to the overall business.

Our team of tax technology professionals offers an unrivalled mix of talent across information technology, tax and accounting in China and Hong Kong. The team has extensive experience in project management, business requirement and process analysis, technical development, quality assurance, systems infrastructure, working with major ERPs, and artificial intelligence tools including RPA, data processing intelligence, and business intelligence analytics.

Combining our tax expertise and cutting edge technology including our proprietary tax technology platform, we provide best practice process optimisation service and automation solution in areas of tax reporting, data management and analytics for tax audit and risk management, corporate tax, value added tax, transfer pricing, R&D incentive, individual income tax/payroll, and more. Tailored to your needs, our team will work with your tax functions to implement a robust, secure and agile tax ecosystem to meet the fast changing business and tax regulatory environment.

Contact us

Asia Pacific International Tax Services Leader, China Tax Digital Products & Solutions Leader, PwC China

Tel: +[86] (21) 2323 3219