Tax risk management

The incorporation of individual anti-tax avoidance terms into China tax law, together with disruptive tax environment in China making the management of tax risks increasingly important.

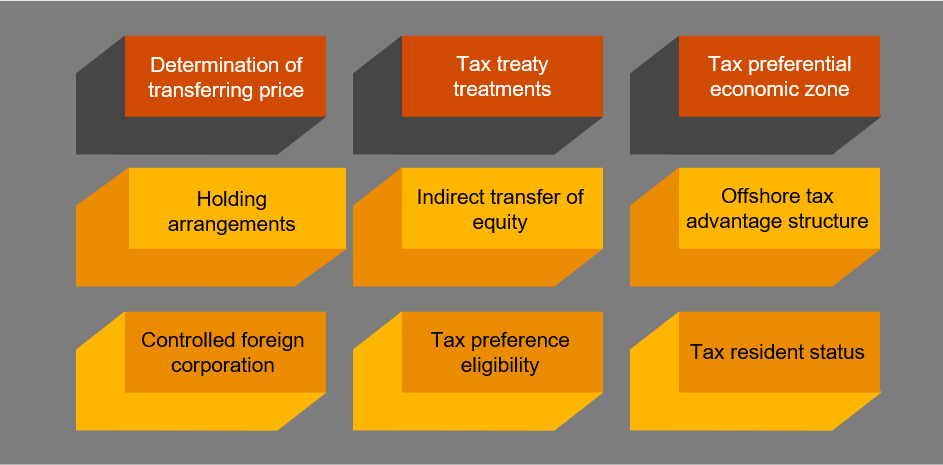

Risk identification

Assess the tax risks of a broad scope of variety of transactions involving individuals

- Whether the tax treaty are improperly applied for illegitimate tax profits?

- Whether profits are transferred to offshore tax heaven for tax evasion purpose?

- Whether tax planning is arranged without commercial substances?

- Whether business activities are carried out lacking of reasonable business purpose?

Risk management

Adjust the transaction structure focusing on the commercial reasonableness and substance and proactively coordinate with tax authority to seek for certainty on tax positions beforehand

- Assist to confirm the benefit approach and procedures for preferential tax treatment, tax treaty claim and tax refund application;

- Assist to negotiate on the uncertain tax positions/ processes under the prevailing IIT regime to achieve certainty and effectiveness in tax arrangement;

- Assist to closely communicate with the in-charge tax official, review and analyze the transaction related information;

- Prepare supporting documents and provide advices on the setup of internal process, so as to avoid potential negative impact on the follow-up anti-tax avoidance investigation.

Risk solution

Assist individuals to effectively respond to anti-tax avoidance investigations, and resolute the tax disputes in a proper manner

- Assist to understand the key points during different stages of tax investigation and prepare the relevant supportive documentation;

- Suggest, prepare for and carry out dispute resolution strategies to unlock entrenched disputes and to resolve or narrow disputes;

- Reduce the potential penalties and negative impacts on taxpayer credit to the extent that relevant regulation allows.